in Danish

The announcement at Adobe Summit, about the availability of Adobe Experience Platform running on Microsoft Azure services, shows how close the technology partnership is between Microsoft and Adobe. It is a big commitment from Adobe into Microsoft building the data foundation of their Experience Cloud in a Microsoft Azure infrastructure and it shows a direction for next generation of enterprise customer data platforms.

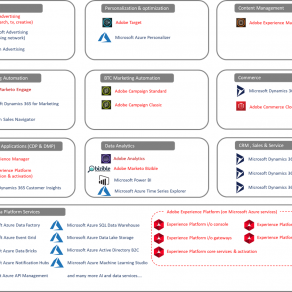

In my research into the Adobe and Microsoft CX technology stack, I have not been able to find an official description of the joint CX technology landscape from Adobe and/or Microsoft. So to get my own head around the combined CX landscape and to see if there are any conclusions to be drawn and questions to be asked, I have created my own version of the combined Adobe + Microsoft CX technology landscape and looked for synergies in the combination of solutions and overlap between similar solutions.

I hope you will read my perspectives on the Adobe + Microsoft CX landscape as a starting point for a discussion about the bigger picture of the enterprise wide CX landscape. It is not the full story, but an attempt to get an overview the solutions – and most of all it is driven by my own curiosity and interest in CX technology.

To get an overview of the CX landscape I have divided all the CX related Adobe and Microsoft solutions into a set of categories that covers platform services and applications and marked all Adobe components in red text and all Microsoft in blue text. I have excluded solutions that are not CX focused but still play a part in the experience proces, like Adobe Creative Cloud applications and Microsoft Office applications.

With this approach I end up with 10 categories and 37 different applications/services, but the landscape could be drawn up more detailed with +50 different applications/services.

THE FOUNDATION OF THE LANDSCAPE IS THE CUSTOMER DATA PLATFORM SERVICES

The very foundation of the combined Microsoft + Adobe CX technology landscape is to be found in the Customer Data Platform Services layer of the landscape. You will not find the Customer Data Platform Services category in Microsoft’s Azure product catalogue or in Adobe’s description of their data platform services, but it is a way to illustrate what companies have been doing for the last couple of years to build a common real-time customer data platform and how Adobe is productizing the domain with their Adobe Experience Platform solution. In the recent years mature CX businesses with a Microsoft preference have built their own customer data platforms using Azure cloud services like Azure Data Factory, Data Lake Storage and API Management. It is a flexible and to some extend fast way to build an enterprise wide customer data foundation, but it requires a dedicated IT development team and Microsoft’s Azure identity services are focused on deterministic PII identities, so MarTech developers will need to include 3. party solutions in the stack to be able to combine 1st, 2nd and 3rd party data across anonymous and known identities.

Adobe Experience Platform is changing the way companies can work with customer data across the enterprise. One way to think about Adobe Experience Platform is as a preconfigured set of customer data platform services that delivers a real-time and scalable cloud based customer data infrastructure for all your enterprise customer data and makes the data available for all your CX applications both inside the Adobe Experience Cloud and to external CX applications.

Adobe Experience Platform is by default running in a Microsoft Azure datacenter and is utilizing Azure infrastructure and data services. This way Adobe Experience Platform get the scalability, efficiency and security of Microsoft Azure and it is very important for Adobe as they move into the area of enterprise customer data with Experience Platform. The CMO is used to work with cloud solutions that are mainly using non-PII or non-sensitive PII data and have been “allowed” by the CIO with limited data security concerns, but as data platforms like Adobe Experience Platform moves into storing, managing and governing business critical PII data it becomes critical that the cloud solutions run in a infrastructure that the CIO trust and can control.

The Adobe Experience Platform takes out a big part of the complexity of building a customer data infrastructure directly in Azure Services and it requires less IT resources/skills to develop and operate. And naturally it comes with native integrations into the Adobe Experience Cloud applications and brings a faster time-to-market for an Adobe end-to-end CX technology landscape. The Adobe Experience Cloud is built with an open API first architecture and it supports a hybrid data repository model, meaning that enterprises that have already built a data repository using Microsoft Azure services like Data Lake Storage or any cloud/on-premise Hadoop cluster can keep the data in the existing setup and integrate the data with Adobe Experience Platform. This way Adobe Experience Platform act as the main customer data hub for analytics, machine learning, segmentation and data activation across channels, but the data resides in a hybrid of data repositories providing a high degree of flexibility and the option for a hybrid on-premise and cloud data governance model.

FROM PLATFORM SERVICES TO CDP AND DMP APPLICATIONS

Where the Customer Data Platform Services are mostly for developers the CDP and DMP applications are built for marketeers to drive cross channel audience orchestration. In the combined Adobe + Microsoft landscape you find Adobe Audience Manager as the DMP handling audiences based on anonymous and pseudo anonymous profiles. The connection between Adobe Audience Manager and Experience Platform utilizes an extensive data repository with structured and semi-structured datasets and creates the ability to activate real-time audiences from a unified online/offline, anonymous/PII customer profile. Adobe Experience Platform is also a real-time CDP application where the Marketeer can create known/people-based audiences for activation across channels and, in this domain, there is an overlap with Microsoft Dynamics 365 Customer Insights. As both CDP applications are very new to the market it is still to be seen if it will make sense to have Dynamics 365 Customer Insights and Adobe Experience Platform running in the same landscape, or if Dynamics 365 Customer Insights will be obsolete in a Dynamics 365 + Adobe Experience Cloud landscape.

ADOBE ANALYTICS AND MICROSOFT POWER BI DELIVER A BROAD ANALYTICS SCOPE

Adobe Analytics and Microsoft Power BI have lived side-by-side for years and they serve two different purposes in the CX landscape. Adobe Analytics is the application for online analytics and the primary tool for the ecommerce, and digital, analyst to perform attribution, conversion and complex end-to-end customer journey analysis, tightly integrated with online optimization in Adobe Target and segmentation/activation in Adobe Audience Manager. Power BI is, on the other hand, the business intelligence tool, dashboard and report builder for the business analyst and line-of-business decision makers. As Adobe customers adopt Adobe Experience Platform as their main customer data infrastructure the analysts will get a ability to query directly into the enterprise wide data repository and the usage of Adobe Analytics and Power BI will blend in. There will be some overlap, but still with different purpose-built usages for each application and the combination of the two tools delivers a full-scale analytics platform for customer data insight users across the complex enterprise.

Microsoft also come with a set of purpose-built analytics services in Azure that will supplement tools like Adobe Analytics and Power BI. For example, Azure Time Series Explorer, which is specifically designed to analyze large time series datasets. For the deeply specialized data scientist, the Customer Data Platforms Services will deliver the data workspace for them to work with AI and ML applications, as well as open source models; in the Adobe Experience Platform the scoring of the models can be included in the customer profile and activated in Adobe Experience Cloud applications, and also through API services to 3rd party applications.

A newcomer to the analytics domain is Marketo Bizible. In April 2018 Marketo acquired the B2B marketing performance management company Bizible, it is a very specific purpose-built solution for B2B revenue attribution and B2B performance insights including demand gen, inbound marketing, account-based marketing, and outbound sales. Bizible will be a fast track for B2B customers to get full pipeline insight compared to building the same functionality in Adobe Analytics or Microsoft PowerBI.

MICROSOFT OWNS THE CORE CRM, SALES AND SERVICE SPACE IN THE LANDSCAPE

Adobe really need the partnership with Microsoft in two areas from a CX perspective – as an enterprise ready cloud platform trusted by the CIO and as core CRM solution trusted by the CSO and CMO. In the CX and Marketing Cloud space the competitors to Adobe are primarily Salesforce and Google, followed by Oracle, Pega, IBM etc. and they all come with CRM core solutions and Adobe does not have a core CRM platform in their CX portfolio. Microsoft and Adobe have announced that they work tightly together in a joint Open Data Initiative also partnered by SAP and they will offer ways to serve data between Dynamics 365, Office 365 and Adobe Experience Platform and Experience Cloud applications.

As core CRM platforms merge tightly with Marketing Cloud and other CX applications, it is crucial for the success of the partnership between Adobe and Microsoft that the Open Data Initiative delivers enterprise ready data connections between the platforms that scales and reduce complexity running end-to-end customer experiences.

From a commercial point of view, it is equally important that Adobe and Microsoft align their sales and channel organizations to compete against Salesforce. When you exclude paid advertising from the combined core CRM and Marketing Cloud technology budget, core CRM is still +70% of the total budget, and in many markets Salesforce is the dominant core CRM vendor having the advantage to leverage a large install base into a combined core CRM and CX domain.

THE MARKETING AUTOMATION SPACE IS AN OVERCROWDED PARTY

Overlooking the total CX landscape, the marketing automation/campaign management category is where the joint Adobe and Microsoft solution portfolio is a bit overcrowded. On the BTB dimension there is potentially a very strong synergy between Microsoft owned LinkedIn combined with Microsoft Dynamics 365 and Adobe Marketo Engage, serving real time user-generated data into the marketing automation platform and giving access to +500 million BTB users of LinkedIn. In terms of core BTB marketing automation capabilities there is a huge feature overlap between Adobe Marketo Engage and Microsoft Dynamics 365 for Marketing. The big difference is that Marketo comes with a much larger install base of clients compared to Dynamics 365 for Marketing. It is going to be super crowded in BTB marketing automation, especially when you add Adobe’s BTC marketing automation solutions to the equation. There is always a minority of BTB clients using a BTC marketing automation platform, so in reality the BTB Marketer has to choose between one Microsoft and three Adobe marketing automation solutions.

On the BTC side Adobe still run with Adobe Campaign Classic (Neolane) and Adobe Campaign Standard (built from scratch by Adobe) side-by-side. It is two different applications, each with their own product roadmap, and in an Adobe Experience Cloud and Experience Platform perspective it is Adobe Campaign Standard who is the long-term winner, as the main data infrastructure for Campaign Standard is based on Adobe Experience Platform.

IN COMMERCE ADOBE AND MICROSOFT SUPPORT AN OMNICHANNEL APPROACH

Together Adobe and Microsoft cover the foundation of omnichannel retail with Microsoft Dynamics for Retail supporting in-store retail concepts and Adobe Commerce Cloud (Magento) supporting online/mobile commerce. Adobe acquired Magento in May 2018, so it is still early stages for Adobe to integrate their Commerce Cloud tightly into the rest of the Experience Cloud suite, but in the long term there is potential strong omnichannel offering in a combined Adobe and Microsoft landscape.

In terms of content management, personalization and optimization, Adobe Experience Manager and Adobe Target, being long term members of the Adobe Experience Cloud family, offer a tightly connected solution. A specialized service like Microsoft Azure Personalizer is a supplement like all the other external AI/ML based recommendation and personalization engines and deployed as a service in the Customer Data Platform layer of the CX landscape.

IS MICROSOFT AND ADOBE GOING TO BE A CONTENDER TO GOOGLE IN THE ADVERTISING SPACE?

Adobe comes into the partnership with Microsoft with a strong Advertising tech stack covering DSP, Search, Creative and TV as well as a strong DMP platform, where Microsoft brings a minority advertising network market share outnumbered by Google multiple times. For companies with a strong 1st party data and open advertising network approach, Adobe delivers a strong platform with possibilities to implement and operate data driven end-to-end advertising. However, the capabilities are not really being amplified by Microsoft’s advertising network, because their market share is low compared to advertising networks of Google and Facebook.

The Adobe and Microsoft partnership has stronger potential when it comes to BTB advertising. LinkedIn is by far the largest dedicated BTB advertising eco-system with +500 million users; working in a BTB domain Adobe and Microsoft have the potential strengthen the position within digital advertising.

THE START OF 2ND GENERATION CX SUITES

The partnership between Microsoft and Adobe is in many ways the start of 2nd generation CX Suites built on a common Customer Data Platform Services foundation in a controlled enterprise cloud infrastructure, as opposed to a bunch of cloud applications stitched together with point-to-point integrations. It has the potential to become an enterprise platform for all customer interactions across the entire customer journey and a common real-time customer data infrastructure, removing the data silos and barriers to create end-to-end customer experience.

It is also the end of procuring MarTech from the CMO office and bypassing the CIO/CTO – it is simply too big an IT project migrating out of legacy customer data warehouses, data marts and other data silos into a real-time customer data infrastructure to make it “just another MarTech app” in the stack. Adobe’s strong CMO position and Microsoft’s strong CIO position is from a commercial point-of-view a very strong joint position and an opportunity for both companies to gain market share in the overall CX market space. I guess that is why they are on the path to integrate their technology stack very tightly.

in Danish